RSUs are a major component of a company’s compensation. A few of my colleagues asked me what I do with my Amazon RSUs and what is the ‘right’ strategy. This post helps with understanding RSUs in more detail. I also explain my rationale for my elections.

To make the best decision about RSUs, it is important to understand the lifecycle of a RSU. There are three crucial dates in the journey - Grant Date, Vesting Date and Sell Date as explained below.

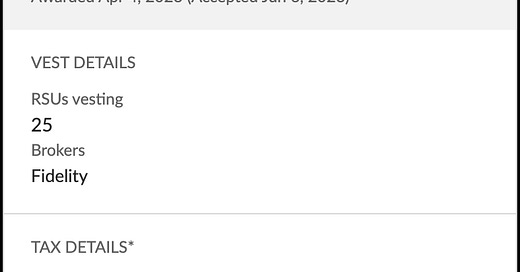

a. Grant Date - the date when RSUs are granted. This usually happens at the time of joining a company, or after a great performance review or after a promotion. As shown below, on April 4th, 2023, I was granted 25 Amazon stocks. My grant date is April 4th, 2023.

b. Vesting Date - the date when the ownership of the RSU moves from the company to the employee. In the example above, the vesting date is May 15th, 2024. This is the date when I will own these stocks.

c. Sell Date - the date when the employee decides to sell the RSUs and take the proceeds as cash.

RSUs are worth nothing until they vest. Upon vesting, RSUs create a tax liability. Upon vesting, each employee is given three options as shown below:

1. Sell for Taxes - this is the default selection and also most common. This means that the brokerage will sell some of the stocks to pay for taxes (based on the tax rate) . The remaining stocks will be kept in the brokerage account. As shown below, out of the 25 stocks that will vest on May 15th, 2024, 8 stocks will be sold to cover the taxes. This is the same as paying taxes on your income .

The remaining 17 stocks continue to be in brokerage until they are sold. Once they are sold, the employee is still liable to pay taxes on the gains. The gains are calculated based on the difference in price at the time stock was sold and price when the stock was granted.

For example, on May 15th, 2024, the stock price was $100. If I sell my 17 shares on Nov 15th, 2024 when the price was $125, I am still liable to pay capital gain taxes on $25*17 = $425. This is the preferred option if you are long on Amazon and want to keep Amazon stocks as part of your portfolio.

Sell All - This means that my brokerage will sell all my stocks and deposit the cash in my bank account after deducting the taxes. There is no capital gain tax as I sold the stocks the day they vested. This is now my money. I can choose to buy Amazon stock again in an open market or choose not to invest at all.

Pay Cash - Choose this option if you want to keep your entire vesting. Essentially, you are depositing cash to pay for the taxes and keeping all the stocks. Once you sell these stocks, you are still liable to pay for capital gain taxes as explained above. Even if someone believes that Amazon stock is supremely undervalued, this is still not the best option. The cash that is deposited to pay for taxes can also be used to buy Amazon stocks on the open market.

In my previous post, I explained how I have an unnerving exposure on Amazon. To trim my exposure, I have chosen the option of ‘Sell All’. I want to sell all my RSUs as soon as they vest and get the cash. Once I have the cash, I have more options and better control. I can rebuy Amazon stock through my preferred brokerage instead of Amazon’s selected brokerage, or I can buy fixed income or just keep the cash.

For someone who believes in Amazon, I would suggest to go with ‘Sell for Taxes’. This covers your taxes and also makes you long on Amazon. If you sell these stocks after 12 months of vesting, you are liable only to pay long term capital gain taxes (15% for income under $492,300) which is less than the tax on the capital gains if the stocks are sold within a year of vesting (same tax as on ordinary income).

While I don’t know the fair value of Amazon stock, I do know that it is trading at a rich valuation compared to other FAANG stocks (~300 P/E). Until I am able to find better opportunities in the market, I will keep selling my RSUs.